How to Build and Finance Your NTM Rollformer All on One Site

Building and financing your NTM machine is now easier than ever.

At New Tech Machinery (NTM), our salespeople know how difficult it can be to navigate financing—applying to lenders, figuring out which is the best fit for you, choosing the loan terms, etc.

Now, we’ve simplified the process: build your machine, find out the cost and estimated monthly payments, and apply for a loan all in one place!

- Build your machine with accessories and options

- See the estimated payment costs as you configure

- Apply for financing and receive approval within hours

You see, New Tech Machinery just made the path to purchasing a portable rollformer a breeze, whether it’s a portable metal panel or seamless gutter machine. With the new machine configurator and a streamlined financing application process, you can build, apply for financing, and get your order placed without spending time talking to different lenders. Our system will match you with a top-notch lending institution.

Below is a concise overview based on NTM’s Financing page, plus guidance on what it means for contractors comparing options.

Quick Wins for Contractors

- Configure first, finance faster: Build the machine you need, then apply—even before your final quote is set.

- Soft credit inquiry: Applying won’t impact your personal credit score.

- Fast decisions: Typical approval details in 4–8 business hours.

- Flexible terms: Options commonly include 36, 48, or 60 months; APR varies by credit profile.

- Multiple structures: Equipment Financing Agreements (EFAs) and Fair Market Value (FMV) leases are available via partners.

- Section 179 potential: Significant year-end tax savings may be available when equipment is placed in service by Dec 31.

Why the Configurator + Financing Combo Matter

- Speed to decision: Configure your machine, apply online, and get connected with a lender within hours. This means you don’t have to shop around trying to find a lender that will finance your purchase and end up with multiple credit checks on your record.

- Cash preservation: Financing spreads cost, letting you invest in coil, labor, and marketing. Financing frees up your cash, allowing you to continue investing in your business.

- Right build, first time: Configure for the profiles, accessories, and add-ons you actually need, or choose from one of our popular machine packages. The configurator adjusts the estimated monthly payments to your added options.

How the Financing Flow Works

- Submit your credit application—even if your quote isn’t finalized.

- Receive approval details (usually within 4–8 business hours).

- Finalize your equipment quote with your NTM sales rep.

- Fund through your matched lender; begin production.

Note: Final approval is subject to credit assessment, underwriting, equipment/vendor approval, and any required documentation. Terms, rates, and amounts vary with creditworthiness and other factors.

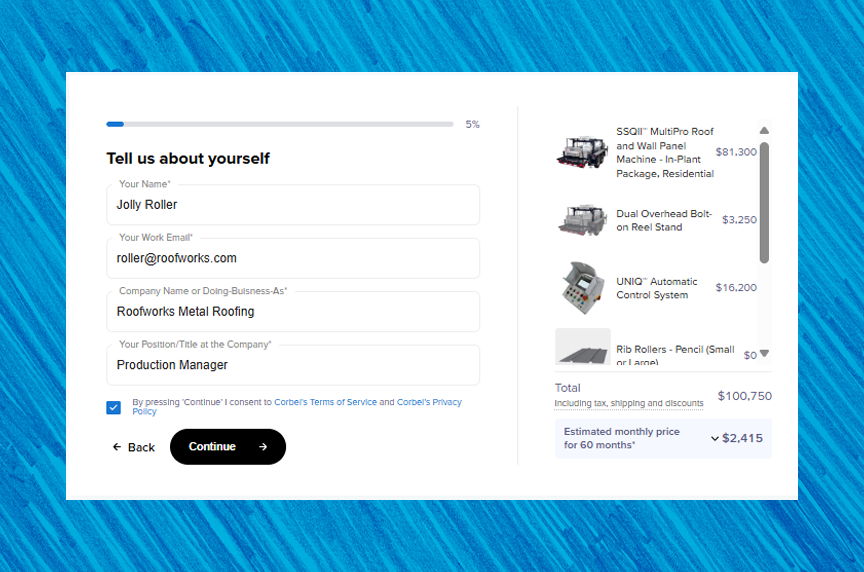

How to Build Your Machine & Apply for Financing, Step-by-Step

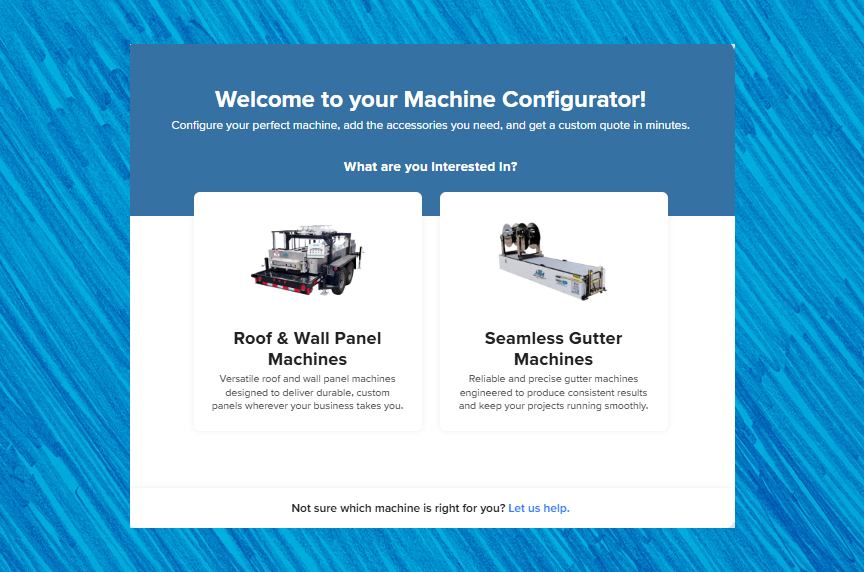

1. Choose your machine type

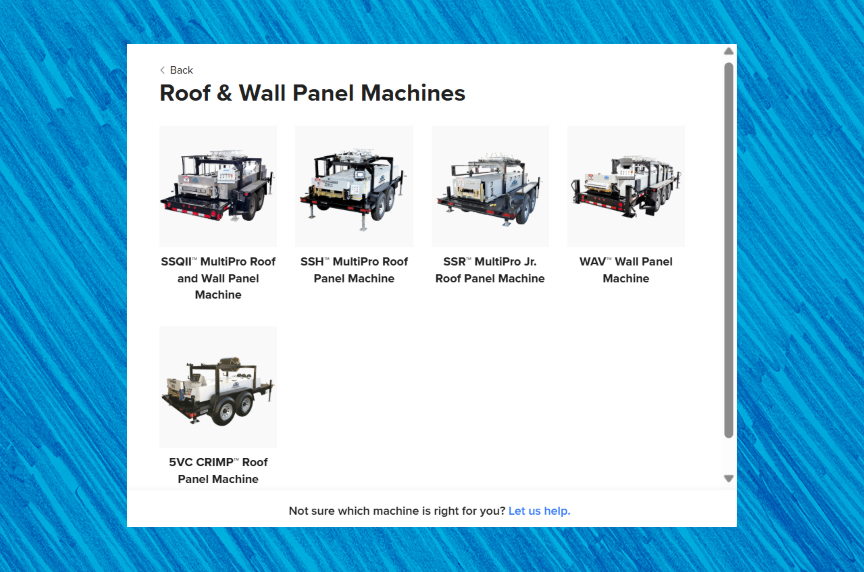

2. Choose your model

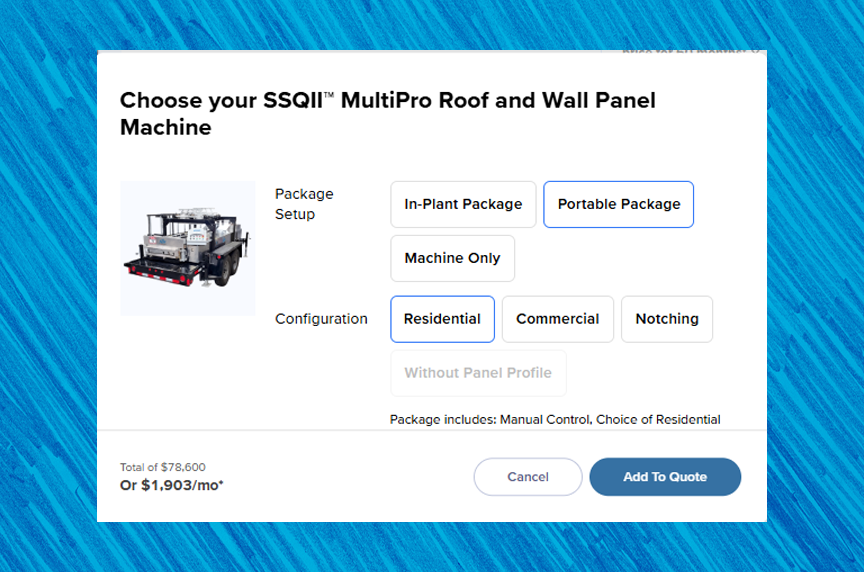

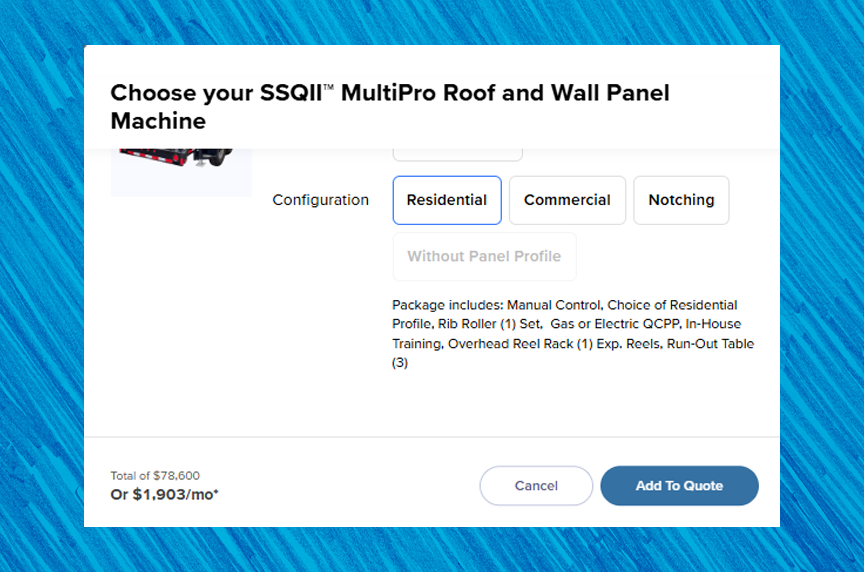

3. Choose your configuration

Scroll down for the description:

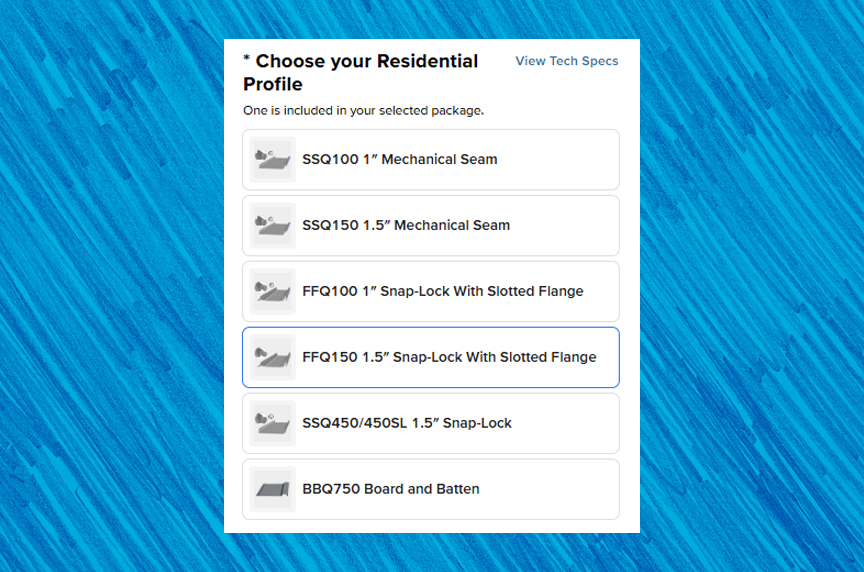

4. Choose your profile(s) (Residential or Commercial, depending on your package choice)

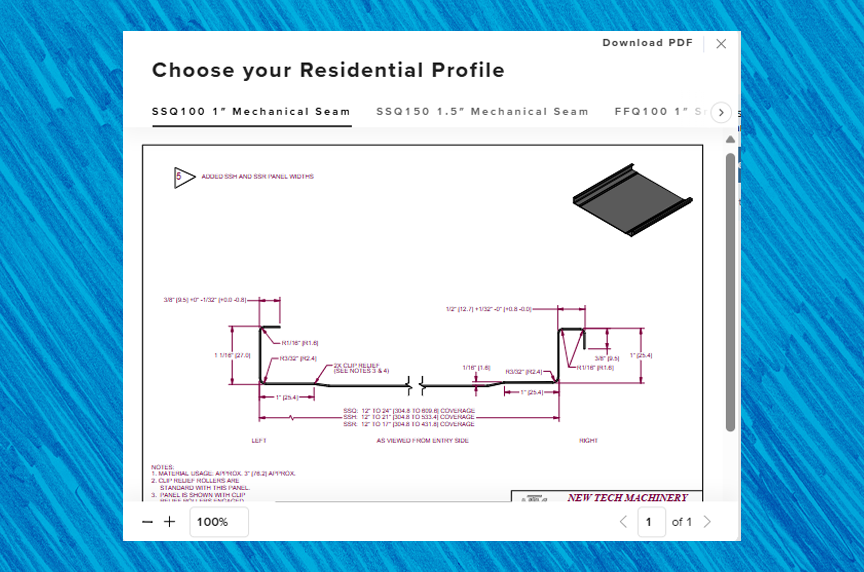

If you need the profile specs, choose the profile first, then click “View Tech Specs”

This will bring up the specs window for that profile

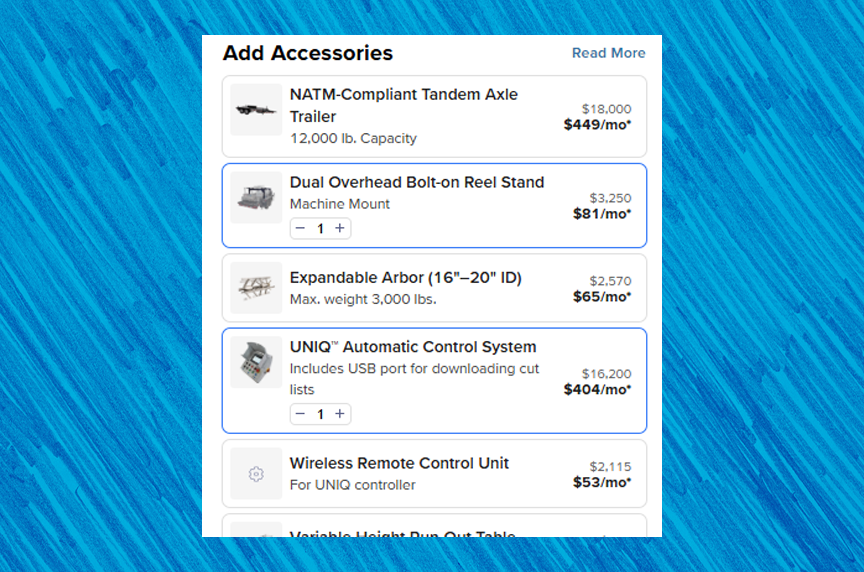

5. Choose your accessories

As you make your choices, you’ll see the cost with the estimated monthly payment

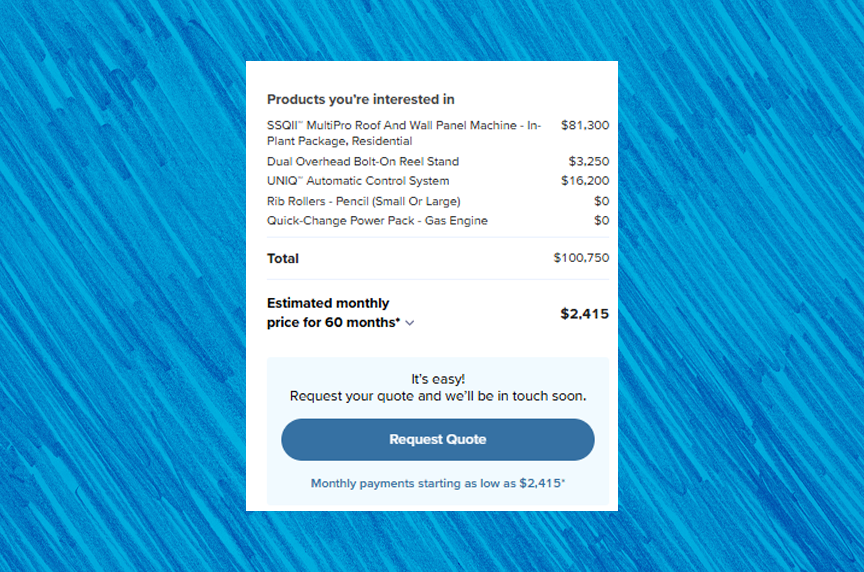

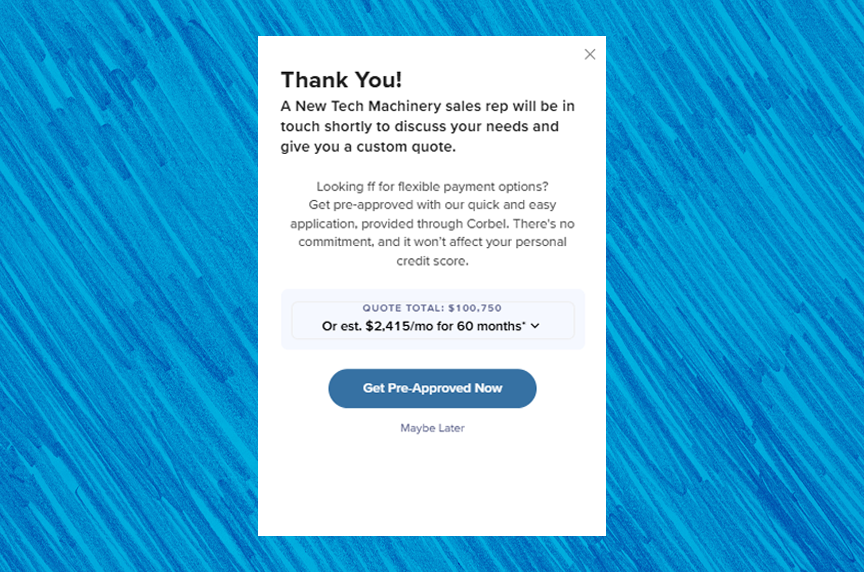

6. When ready, click “Request a Quote”. A confirmation window will pop up with the option to apply for loan pre-approval.

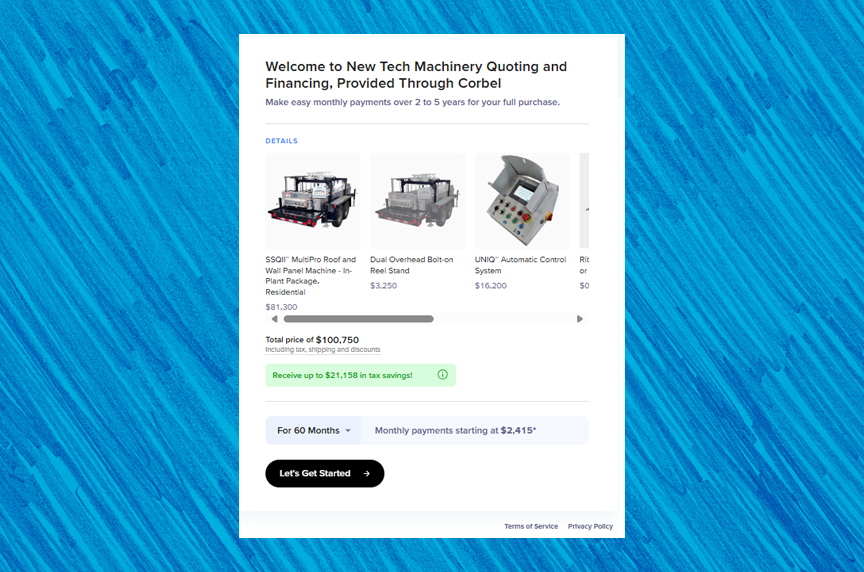

7. Check that your order is listed correctly at the top. To fill out the application, click “Let’s Get Started”. This will take you through the application process. You should receive an answer in 4-8 hours.

8. Begin the application process. Review your order details before proceeding.

Your Financial Partner

- NTM does not finance in-house; they partner with Corbel, a technology company that partners with top-tier equipment finance providers.

- Corbel powers the technology and lender network, helping maximize approvals and competitive rates.

- Financing agreements are strictly between you (the purchaser) and the lender.

FAQs

Tax Benefits

Some seismic changes in tax benefits have taken place since July 4. While this outline provides some guidance, it’s essential to consult a tax specialist to determine your eligibility. We’re presenting this for general information, but we specialize in building the best portable rollformers in the industry, not accounting!

Section 179: pay over time, save on taxes now

- Since the spending bill (Big Beautiful Bill) passed this summer, the Section 179 deduction limit was raised to $2,500,00 for 2025.

- Enhances cash flow: You can make monthly payments while capturing the full deduction in the current year.

- Always consult your tax professional. Eligibility and limits depend on total equipment purchases and business income.

Bonus Depreciation

- Section 168(k) is now 100% deductible.

- No more phasing—equipment purchased in 2025 can be fully deducted in the same year.

- This includes rollformers, forklifts, trailers, and jobsite equipment.

Pros and Cons at a Glance

Pros

- Fast approvals with a soft credit check

- Multiple lenders and structures (EFA, FMV lease)

- Section 179 can materially lower your tax bill

- Apply before your final quote to keep momentum

Cons

- Rates and terms depend on credit; APR can vary widely

- Third-party financing adds another party to the process

- Section 179 requires the machine to be in service by year-end

Tips to Get the Most From the Process

- Configure precisely: Know your profiles, accessories, and add-ons to select the right machine options up front. Speak to an NTM account manager if you’re unsure, but please note that you can still make changes to the final quote. Your configurator is just an estimator. You will submit a final invoice to the lender to initiate the loan.

- Compare structures: EFAs vs. FMV leases have different tax and end-of-term implications—ask your lender and CPA which fits your goals.

- Plan for year-end: If Section 179 is part of your strategy, build in time for delivery, setup, and putting the machine into service before Dec 31.

Bottom Line

Financing an NTM portable rollforming machine has never been easier. Whether you’re in the market for a standing seam, metal siding, or seamless gutter machine, we’ve made it easy for you to choose what you need and match with a lender, all hassle-free. To speak with an account manager, contact us. They’re available to answer any of your